charitable gift annuity minimum age

2 Many universities and nonprofit organizations offer charitable gift annuities. Assuming that the annuitant will be nearest age 65 on the annuity starting.

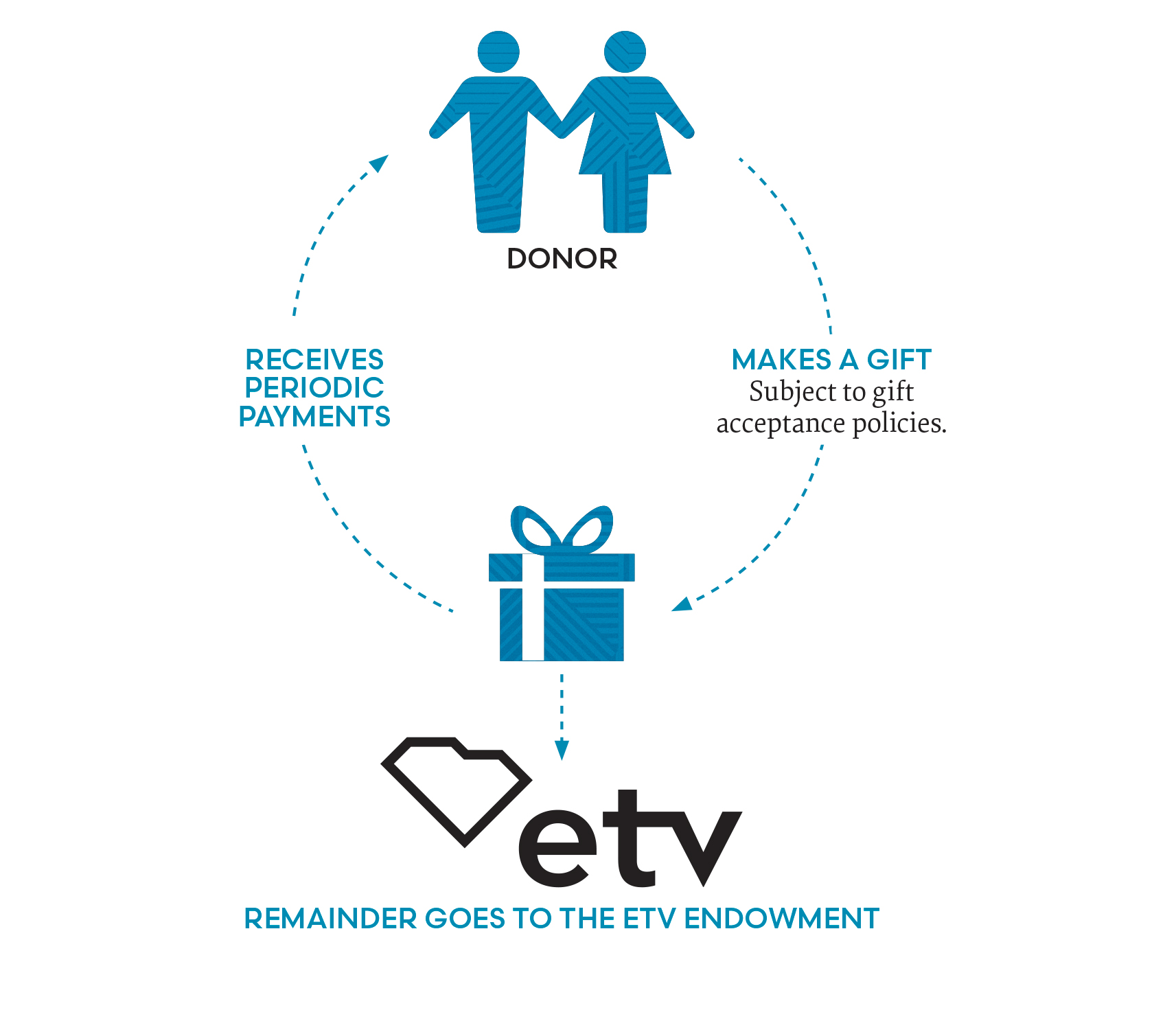

Charitable Gift Annuity Etv Endowment Of South Carolina

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

. Our minimum age for a payment recipient is 60. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. Fixed Payments for Life In exchange for your irrevocable gift of cash securities or other assets NCCF will pay you.

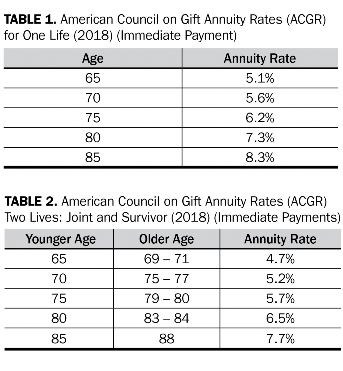

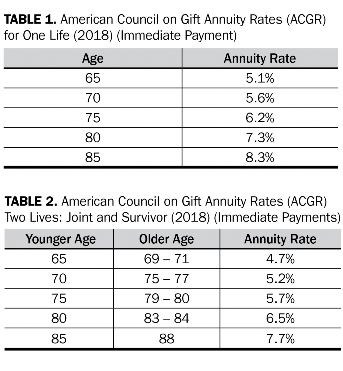

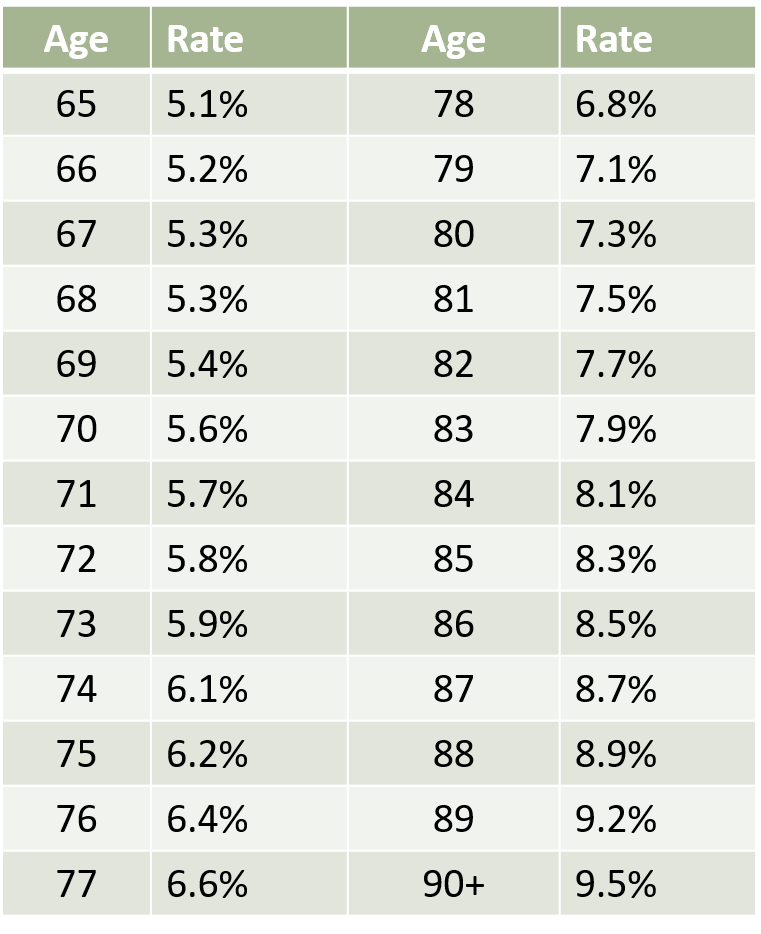

Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. For a single-donor annuity the American Council on Gift Annuities suggests the following payout rates based on age. Annuities are often complex retirement investment products.

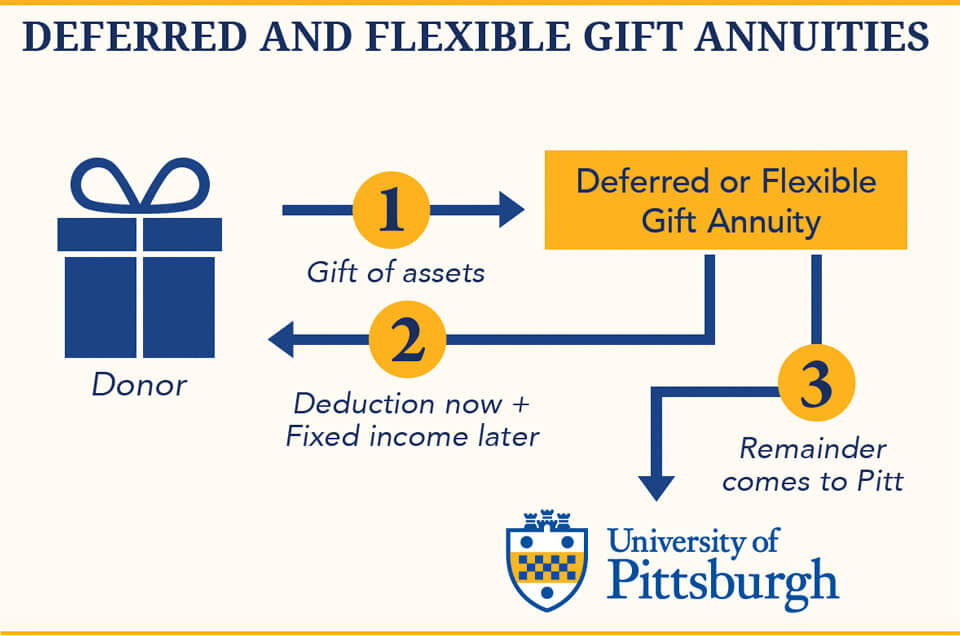

The minimum age to establish a CGA with the AACR is 60 and the minimum gift amount is 50000. You are at least 50 years old for a deferred or 60 for an immediate annuity. 133 rows If payments will be made semi-annually the annuity starting date in this case is April 1 2032.

In exchange the charity assumes a legal obligation. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. Sample Annuity Rates for Gift Amount of 100000 Tax Benefits You will earn an immediate income tax charitable deduction in the year.

The minimum required gift for a charitable gift annuity is 10000. In addition to a lifelong annuity and an immediate tax deduction other benefits of. The minimum age for an AACR Foundation gift annuity is 60.

A charitable gift annuity is a contract between you and Harvard backed by the assets of the University. However payments cannot start until the annuitant reaches age 60. Current Rates of Charitable Gift annuities for one person.

In addition to the income stream annuitants may also be eligible to take a tax. Charitable Gift Annuity A Gift to the Church that Gives Back to You. Offers a pooled income fund charitable gift annuities charitable remainder unitrusts charitable remainder annuity trusts and Donor-.

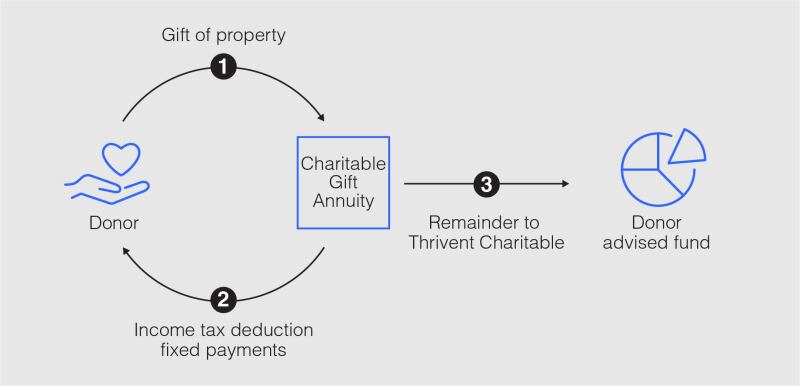

You love helping animals. A charitable gift annuity CGA is an arrangement whereby assets are given to a charity in return for the charitys promise to make lifetime payments of a fixed amount to a. Deferred annuities are available to donors age 50 and above.

Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios. For example a single person who is 70 years old receives a payment rate of 53. If the sole annuitant will be nearest age 65 on the annuity starting date and the compound interest factor is 1320577 the deferred gift annuity rate would be 1320577 times 42.

A deferred charitable gift annuity is a deal where you give your money and in return the charity pays you fixed payments for the rest of your life. In the case of. Please send me a.

Initial funding may be as little as 5000 though they tend to be much larger. Ad Read About Charitable Habits of the Affluent in the Bank of America Philanthropy Study. The minimum age for an annuitant is 55.

This type of planned giving. Each payment amount is based on age and the elapsed time. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

Your charity should have a written policy on the minimum age acceptable to you. The minimum CGA donation to the HSUS is 10000 either in cash or with long-term appreciated stock. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of your life minimum.

You Control When Income Begins. 60 39 65 42 70 47 75 54 80 65 85. The minimum amount to establish a gift annuity is 10000.

Even so some younger people want to make gifts through charitable annuities. You qualify for a partial income tax charitable deduction. They start on a day that you choose at least 1.

Others require you to be at least 65 years old to start receiving payments. The amount of your. Search For Charitable Gift Annuity at Bestdiscoveriesco.

Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Learn some startling facts. Ad Find Charitable Gift Annuity.

The older you are when you fund a gift annuity the higher the payment will be. Annuity payments are deferred until you choose to start them at age 65 or older with a. The minimum age to receive income is 60 years old.

How is a Gift Annuity Created. The rate for a. The minimum amount necessary to create a gift.

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Msu Extension Montana State University

Charitable Gift Annuities The University Of Pittsburgh

What Is A Charitable Gift Annuity Thrivent

What Is A Charitable Gift Annuity Thrivent

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuities Suny Potsdam

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuities Uchicago Alumni Friends

Planned Gifts The Catholic Foundation

A Great Time To Consider A Charitable Gift Annuity Wels

Planned Giving St John S Episcopal Church

Is A Roth Conversion Right For You Vanguard Roth Conversation Ira

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuity Deferred University Of Virginia School Of Law

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center