hotel tax calculator texas

Your average tax rate is. If you want to boost your paycheck rather than find tax.

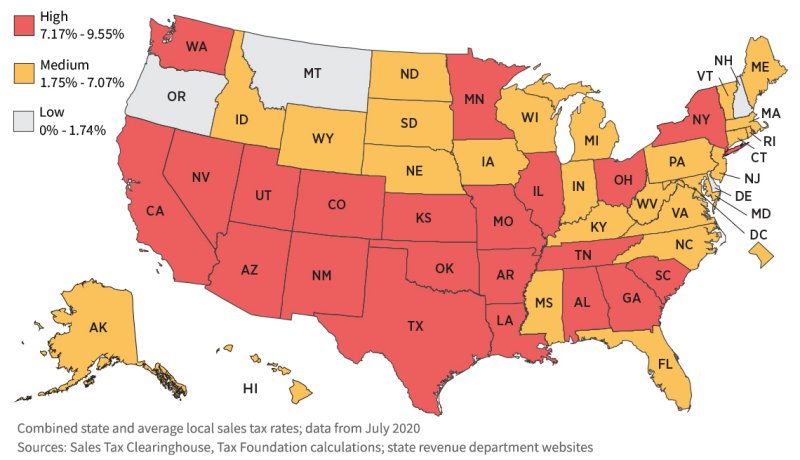

States With Highest And Lowest Sales Tax Rates

And all states differ in their.

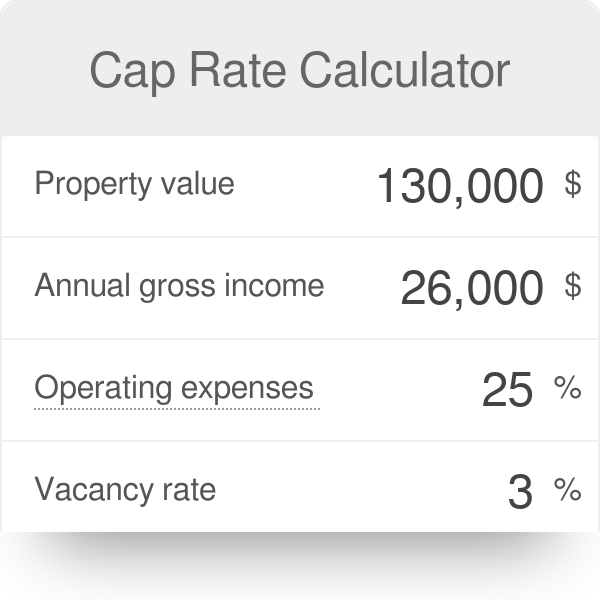

. Hotel and Short Term Rental Tax Calculator. P the principal amount. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for each month of the year.

TAX CODE CHAPTER 351. Junction in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Junction totaling 2. The state hotel occupancy tax rate is 6.

So if your. City Hotel Occupancy Tax is 9. MUNICIPAL HOTEL OCCUPANCY TAXES - Texas Sales Tax Calculator Sales Tax Table Sales.

All payments should be mailed to. Junction Sales Tax Rates for 2022. Local hotel taxes however are due only on those rooms ordinarily used for.

This is not an official tax report. Galena Park ISD is exempt from paying the Texas. Ad Finding hotel tax by state then manually filing is time consuming.

The State of Texas imposes an additional Hotel Occupancy Tax. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. Texas tax code chapter 351 and tax code chapter 352 give municipalities the authorization to levy a tax on a person who pays for the use of a hotel room as defined by tax code chapter 156.

Ad Finding hotel tax by state then manually filing is time consuming. Galveston Park Board HOT Tax. 7 state sales tax plus 6 state hotel tax 13 if renting a hotel or room.

601 Tremont 23rd Street. To report and pay your taxes you must log in to your. Please read and adhere to the Hotel Occupancy Tax Reporting Payment Requirements and Exemptions.

Notable examples include its hotel occupancy tax which is 6 of the cost of a hotel. Convention hotels located within a qualified local government unit with 81-160 rooms rate is 30 and 60 for hotels with more. So if the room costs 169 before tax at a rate of 0055 your hotel tax will add 169 x 0055 9295 or an extra 930 per night.

Hotel Occupancy Tax is imposed by states cities certain counties and special purpose districts on the rental of a room or space in a hotel. Avalara automates lodging sales and use tax compliance for your hospitality business. The City of Austins Hotel Occupancy Tax rate is 11 percent comprised of a 9 percent occupancy tax and an additional 2 percent venue project tax.

54 rows 3 State levied lodging tax varies. A state employee is not exempt from paying a state. A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business.

Avalara automates lodging sales and use tax compliance for your hospitality business. Just enter the five-digit zip code of the. The HOT Tax and STR registration forms are now available online at Galveston Occupancy Tax.

This tool is provided to estimate past present or future taxes. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room. Failure to comply may.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Get Your Free.

Texas law requires that each bill or other. How You Can Affect Your Texas Paycheck. Texas Hourly Paycheck Calculator.

I your monthly interest rate. A state employee may only be reimbursed for his or her actual lodging expense not to exceed the maximum lodging reimbursement rate for that location. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

That means that your net pay will be 45705 per year or 3809 per month. City Hotel Occupancy Tax is due when the full room rate is paid and cancellation is within 30. Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax.

Below is a summary of key information. 7 state sales tax plus 1 state hotel tax 8 if renting a whole house. Cities and certain counties and special purpose districts are authorized to impose an additional local.

Before-tax price sale tax rate and final or after-tax price. Texas also charges a number of additional fees and taxes on the sales of certain goods. So your big Texas paycheck may take a hit when your property taxes come due.

Texas Hotel Tax Exempt Form 2017 2019. If you make 55000 a year living in the region of Texas USA you will be taxed 9295.

Jerry S World In Frisco Texas Dallas Cowboys Dallas Cowboys

Texas Income Tax Calculator Smartasset

The Early Retirement Calculator Will Tell You When You Will Be Able To Retire And Live Off Your Passive Incom Retirement Calculator Early Retirement Retirement

Long Term Tax Strategies For Student Loan Borrowers 10 Things The Borrowers Money Blogging

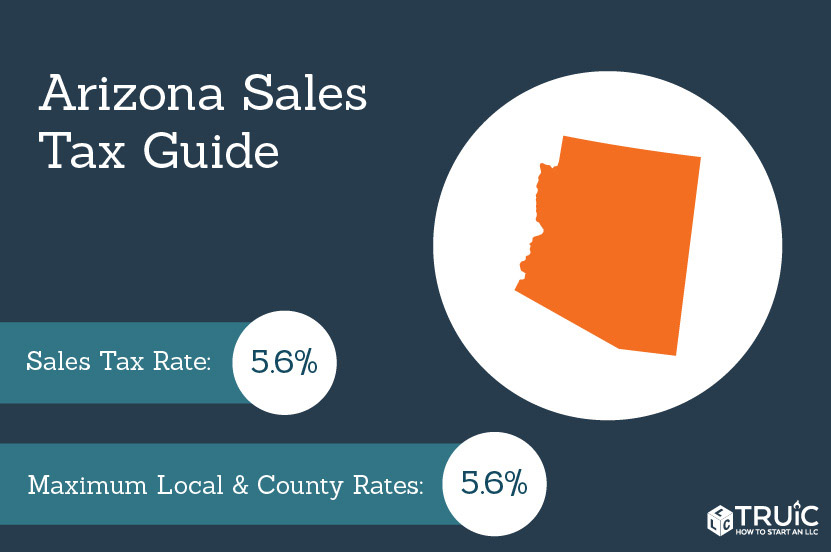

Arizona Sales Tax Small Business Guide Truic

Sales Tax Calculator Apps On Google Play

The Independent Contractor Tax Rate Breaking It Down Benzinga

Is Tax Included With That A Hotel Tax And Sales Tax Guide Texas Hotel Lodging Association

Http Www Magneandassociates Com In 2021 Household Expenses Mortgage Loans Credit Cards Debt

Florida Property Tax H R Block

Truly Calculator Calculators Calculator Power

What Is Hotel Occupancy Tax Texas Hotel Lodging Association

Do You Know How Much You Pay In Federal State And Local Taxes Online Taxes Bean Counter Tax

Texas Sales Tax Calculator Reverse Sales Dremployee